INVESTMENT in 2025

This page summarizes monthly returns of the investment portfolio of the Hoperation Fund in 2025, with screenshots of its investment account. Each screenshot gives the initial and final balance of a month, with cash inflow (capital from contributors and fundraising events) and cash outflow (capital requested back by contributors, or capital withdrawn to donate charitable organizations).

2025 overview

In 2025, the return of the Hoperation Fund investment portfolio was 16.5%. Since its inception in June 2023, the portfolio has delivered a cumulative return of 103.3%, significantly outperforming major benchmarks such as the SPY (S&P 500 Index ETF) and QQQ (Nasdaq-100 Index ETF), which returned 68.6% and 79.9%, respectively.

2025.1

In January, our investment portfolio achieved a 1.79% return, increasing the Hoperation Fund's balance to $23,202.36.

The portfolio allocated 3% of capital to purchase BLDR for a short-term trade, along with other short-term traded ETFs.

2025.2

In February, the Hoperation Fund's investment portfolio recorded a -1.03% return, bringing the total balance to $23,919.77.

The portfolio sold BLDR and other short-term traded ETFs, while also reducing holdings in technology stocks.

Additionally, NVO was purchased with 1% of capital, and the portfolio now maintains 16% in cash.

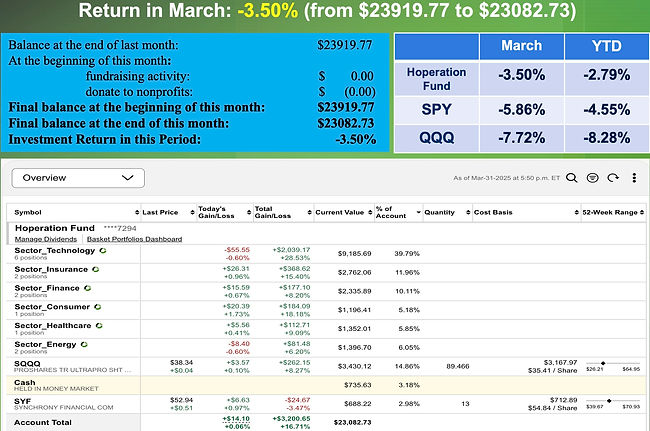

2025.3

In March, the Hoperation Fund's investment portfolio posted a -3.50% return, closing the month with a total balance of $23,082.73.

15% of capital has been used for hedging. The portfolio now maintains 3% in cash.

2025.4

In April, the Hoperation Fund’s investment portfolio recorded a return of -4.20%, ending the month with a total balance of $22,113.73.

During the month, the portfolio exited its position in SYF and added exposure to the gold ETF IAUM, as well as increased its holdings in SQQQ. By month-end, approximately 19% of the capital was allocated to hedging positions.

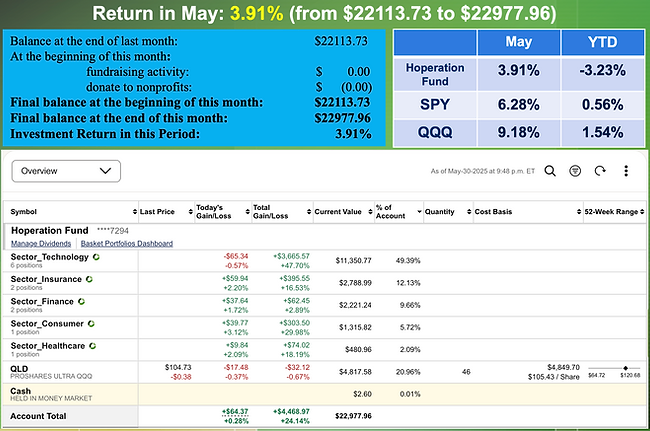

2025.5

In May, the Hoperation Fund’s investment portfolio achieved a return of 3.91%, closing the month with a total balance of $22,977.96.

During the month, the portfolio exited positions in SQQQ, IAUM, and all energy stocks. It then realized gains through trades in TQQQ and increased its holdings in technology companies, including NVIDIA, Meta, and Alphabet. Additionally, the fund initiated a new position in QLD, allocating 21% of capital to the trade.

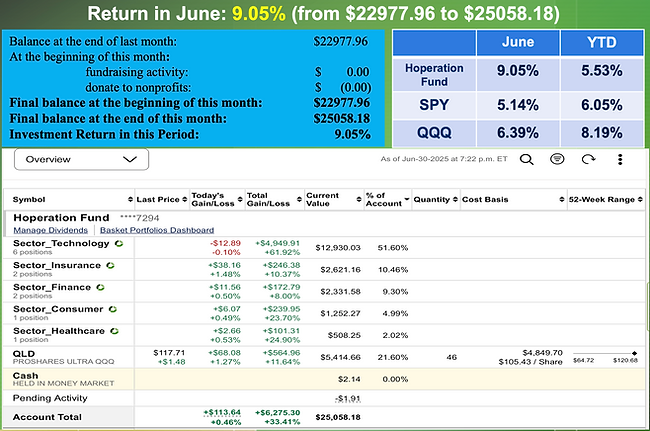

2025.6

In June, the Hoperation Fund’s investment portfolio achieved a return of 9.05%, closing the month with a total balance of $25058.18.

During the month, the portfolio underwent minor adjustments in technology holdings, including the sale of some GOOGL shares and the purchase of additional shares in NVDA and META.

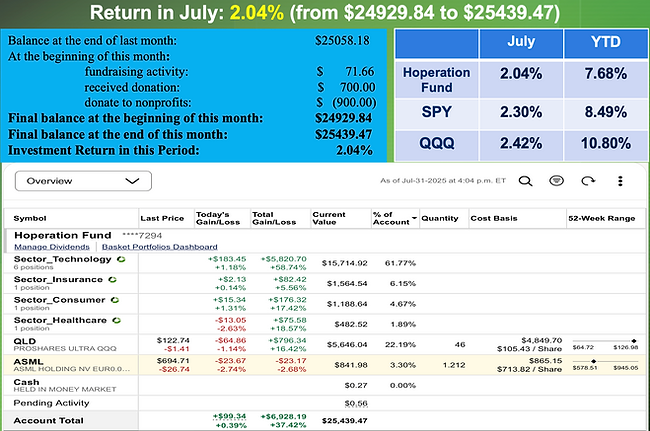

2025.7

In July, the investment portfolio delivered a 2.04% return. During the month, the portfolio closed all positions in the finance sector to free up capital for a donation, while the remaining cash was used to increase holdings in existing positions and to initiate a new position in ASML.

This month also saw capital inflows from our recent fundraising activity ($71.66) and a contribution of $700, alongside a capital outflow for our donation to the Libuton Elementary School.

2025.8

In August, the investment portfolio delivered a 0.59% return. During the month, the portfolio closed the position in QLD, while increased holdings in existing positions in AVGO, GOOGL, ASML, and to initiate new positions in SPMO and SOXL.

2025.9

In September, Hoperation Fund's investment portfolio delivered a 5.26% return. During the month, the portfolio closed the positions in SPMO, SOXL, and PGR, round-trip traded QLD, and finally initiated a new position in SSO.

2025.10

In October, Hoperation Fund's investment portfolio delivered a 6.88% return. During the month, the portfolio closed the positions in NFLX, SSO and the consumer sector, added more shares in some technology stocks, and initiated a new position in QLD.

2025.11

In November, Hoperation Fund’s investment portfolio returned -4.12%. During the month, we closed our positions in QLD and ASML, and initiated new positions in UPRO and EWP.

2025.12

In December, Hoperation Fund fully liquidated its UPRO position and withdrew $50 to donate to Wikipedia. Hoperation Fund then increased its allocation to EWP and initiated new positions in EWZ and QLD, while also trading MRK for a gain. After these adjustments, the portfolio remains about 8% in cash.